Federal student loans repayment can be confusing, but understanding interest rates, repayment flexibility, and borrower protections help you make the best financial decision.

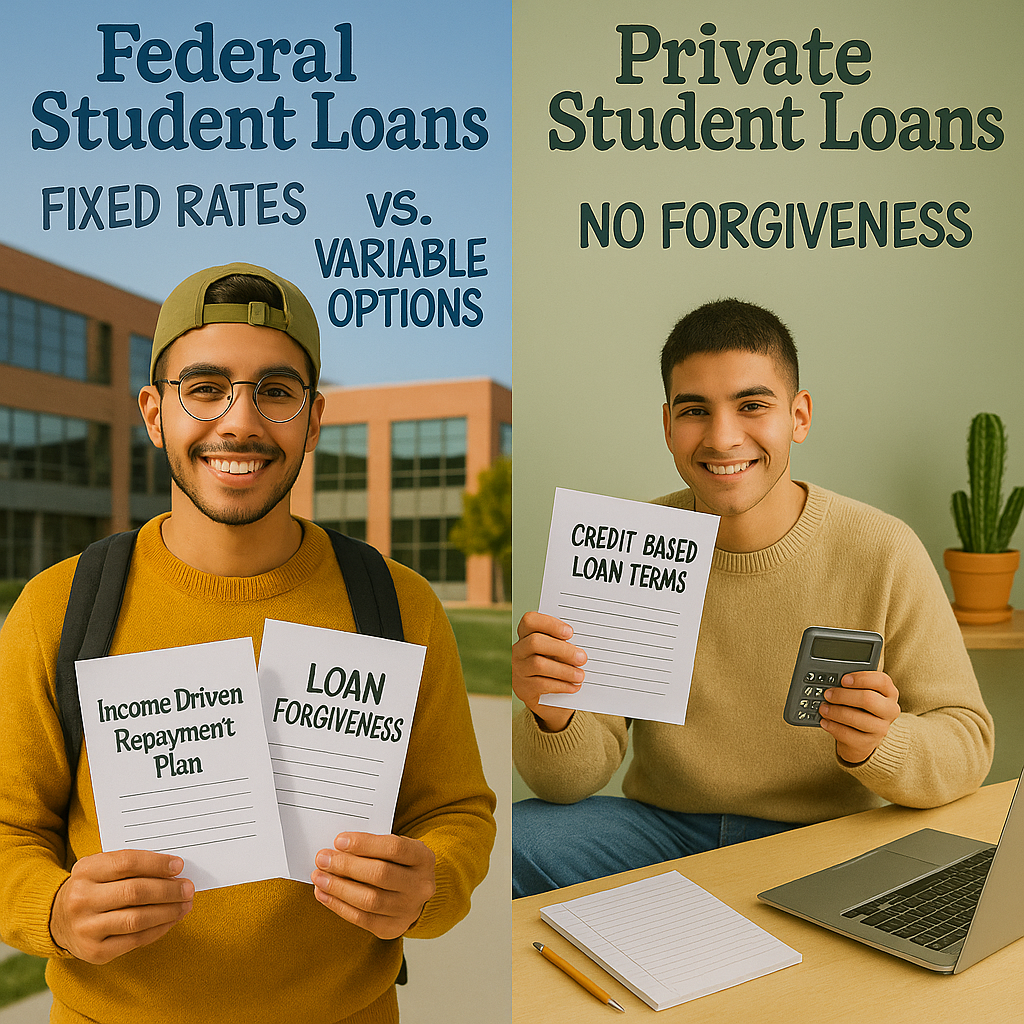

Federal vs. Private Student Loans: Key Differences

Understanding Interest in Student Loans Calculator

Federal student loans have fixed interest rates set by the government, which tend to be lower than private loans. Private student loans, on the other hand, may have fixed or variable rates, determined by lenders based on the borrower’s credit history. Using a student loan repayment calculator can help estimate monthly payments under different scenarios.

Federal Student Loans Payment Flexibility

One of the biggest advantages of federal student loans repayment is the availability of income-driven repayment plans. These allow borrowers to adjust monthly payments based on their earnings, providing much-needed financial relief. In contrast, private loans typically require fixed monthly payments, offering limited repayment flexibility.

Borrower Protections and Student Loan Repayment Programs

Federal student loans repayment comes with forbearance, deferment, and loan forgiveness programs for eligible borrowers. These protections ensure that those facing financial hardships have options to manage their debt. Private loans, however, generally lack forgiveness options and come with stricter repayment terms.

Pros and Cons of Federal vs. Private Student Loans

Federal Student Loans Interest and Repayment Plans

✅ Pros:

- Lower interest rates

- Flexible repayment plans

- Loan forgiveness programs

- No credit check required for most loans

❌ Cons:

- Borrowing limits may not cover full tuition

- Limited options for graduate students

Private Student Loan Repayment Considerations

✅ Pros:

- Higher borrowing limits

- Can help cover costs beyond federal loan limits

- May offer lower rates for borrowers with excellent credit

❌ Cons:

- Higher interest rates

- Limited repayment flexibility

- No loan forgiveness programs

Making the Right Choice for Your Student Loans Repayment

Choosing between federal and private student loans depends on your financial situation and education costs. Federal loans generally offer better protection and lower rates, while private loans can help fill funding gaps.

Stay tuned for our upcoming posts, where we’ll explore student loan repayment strategies, loan forgiveness programs, and tips on using an interest on student loans calculator effectively!