Choosing the right income-driven repayment plan for student loans is essential for managing your finances effectively. Understand different options to make informed decisions and avoid financial stress.

Overview of Student Loan Repayment Options

Standard Repayment Plan

For borrowers who prefer a fixed approach, the standard repayment plan offers:

- Fixed monthly payments over 10 years.

- Ideal for those with stable income who want to pay off their loans quickly.

Income-Driven Repayment (IDR) Plans

If you’re looking for flexible payments based on your earnings, an income-driven repayment plan for student loans might be a better fit. These plans adjust monthly payments according to your income and family size.

Types of IDR Plans

Types of IDR Plans

- Income-Based Repayment (IBR) – Payments at 10-15% of discretionary income, with loan forgiveness after 20-25 years.

- Pay As You Earn (PAYE) – Requires 10% of discretionary income, with forgiveness after 20 years.

- Saving on a Valuable Education (SAVE) Plan – Provides lower payments and offers forgiveness after 10-25 years, depending on the loan balance.

- Income-Contingent Repayment (ICR) – Payments set at 20% of discretionary income or based on a 12-year fixed plan, with forgiveness after 25 years.

Strategies for Managing Student Loan Payments

1. Choose the Right Repayment Assistance Plan Based on Your Income

- If your earnings are inconsistent, an income-based repayment plan ensures affordability.

- A standard repayment plan may work best for borrowers with steady income who want to minimize interest costs.

2. Consider Loan Consolidation or Refinancing

- Federal loan consolidation helps simplify payments but may extend repayment terms.

- Private refinancing can reduce interest rates but removes federal protections.

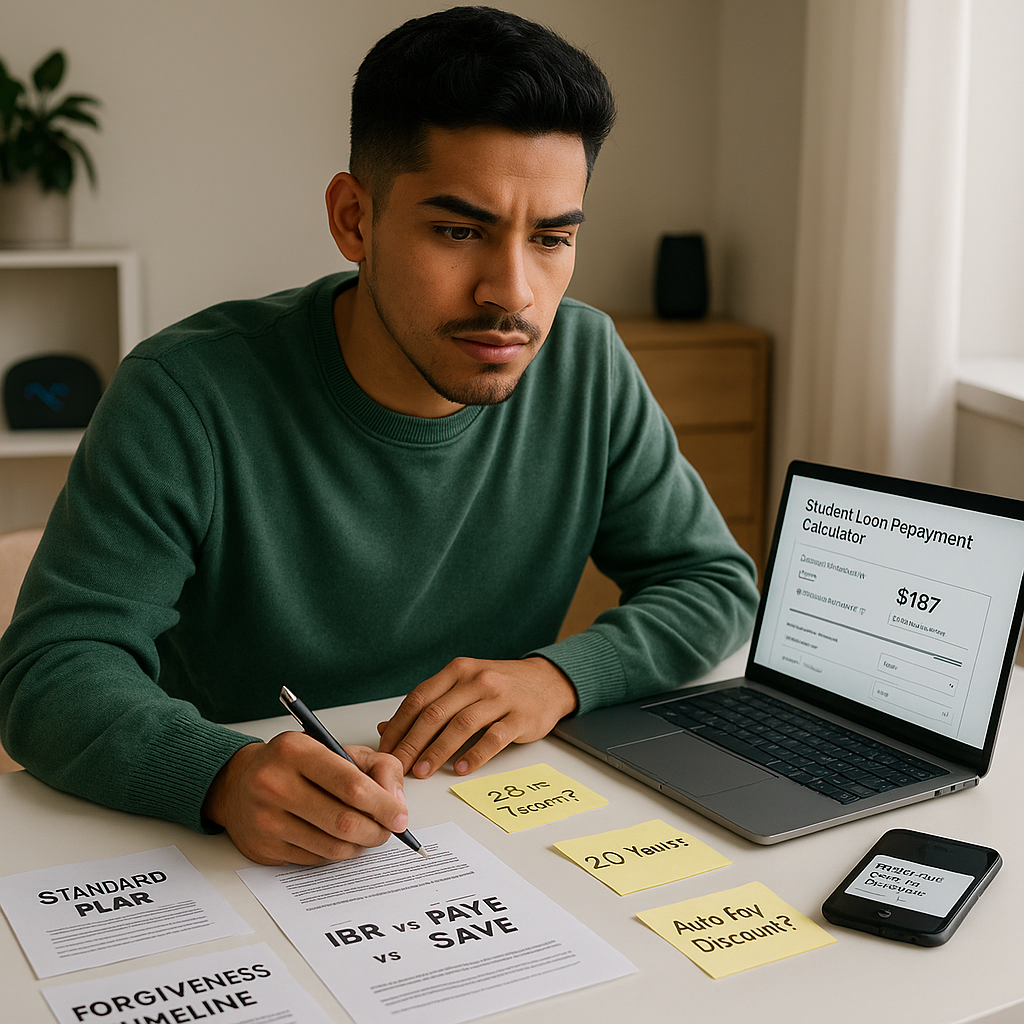

3. Utilize a Student Loan Repayment Calculator

- A student loan repayment calculator helps estimate monthly costs under different plans.

- Tools like a student loan payment calculator allow better financial planning.

4. Set Up Automatic Payments

- Some lenders offer discounts for autopay enrollment.

- Auto payments prevent missed due dates and late fees.

5. Apply for Deferment or Forbearance When Necessary

- If facing financial hardship, temporary relief options like forbearance or deferment can provide flexibility.

- Interest may continue to accumulate during these periods.

Final Thoughts

Choosing the right income-driven repayment plan for student loans is key to staying financially secure while pursuing higher education. Stay proactive, compare options carefully, and make a decision that aligns with your financial goals.