Discover how federal student debt forgiveness programs can help you reduce your student loan burden. Learn about eligibility, application steps, and key forgiveness options.

Student loan debt can feel overwhelming, but student debt forgiveness programs offer relief for eligible borrowers. Understanding how these programs work and whether you qualify can help you take advantage of financial assistance and reduce your debt burden.

Exploring Federal Student Debt Forgiveness Options

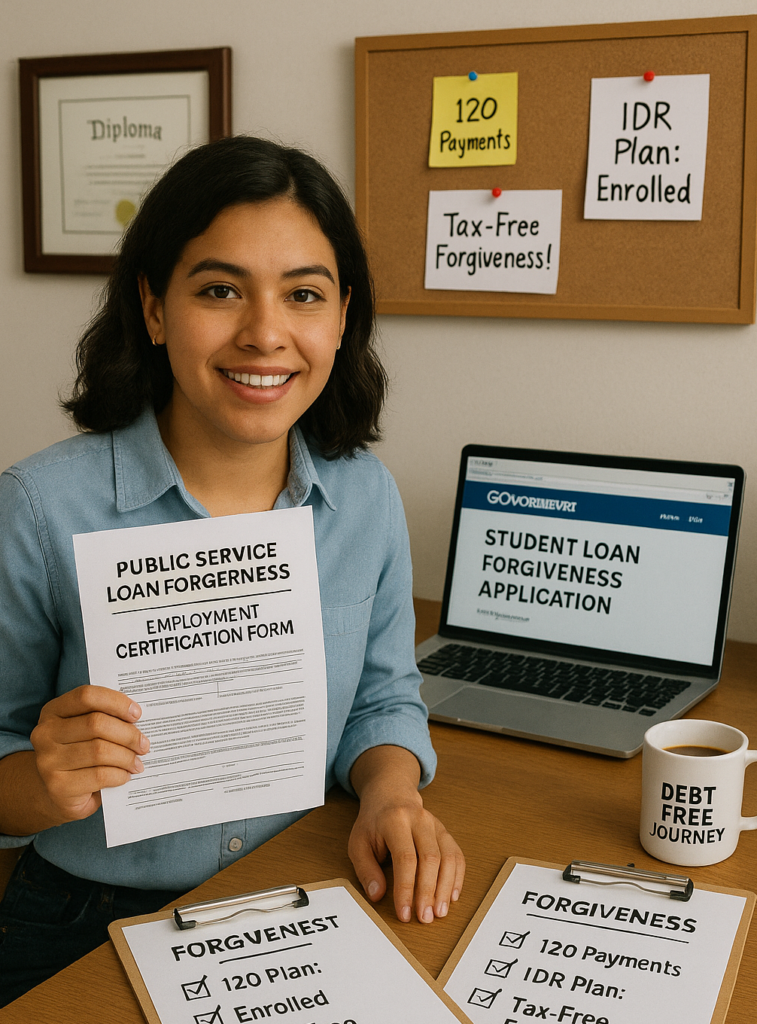

Public Service Loan Forgiveness (PSLF)

- Designed for borrowers working in government or nonprofit organizations.

- Requires 120 qualifying monthly payments under an income-driven repayment (IDR) plan.

- After meeting the requirements, the remaining balance is forgiven tax-free.

Teacher Loan Forgiveness

- Available for full-time teachers in low-income schools.

- Forgives up to $17,500 in federal student loans after five consecutive years of teaching.

- Applies only to Direct Loans and FFEL Program loans.

Other Loan Forgiveness Programs

- IDR Loan Forgiveness – Loans are forgiven after 20–25 years of payments under an IDR plan.

- NHSC Loan Forgiveness – Offered through the National Health Service Corps for medical professionals in underserved areas.

- Perkins Loan Cancellation – Available for teachers, nurses, and public service workers, with gradual loan forgiveness over several years.

Step-by-Step Guide to Qualify and Apply

1. Determine Your Eligibility

- Check if your job qualifies under student loan forgiveness for public service or Teacher Loan Forgiveness.

- Verify that your loans are federal Direct Loans (some forgiveness programs don’t apply to private loans).

2. Enroll in a Qualifying Repayment Plan

- PSLF requires income-driven repayment (IDR) plans.

- Teacher Loan Forgiveness requires standard or graduated repayment plans.

3. Submit Required Forms

- PSLF Employment Certification Form – Submit annually to track progress.

- Teacher Loan Forgiveness Application – Apply after completing five years of teaching.

4. Make Qualifying Payments

- Ensure payments are on time and meet program requirements.

- Keep records of employment and payment history.

5. Apply for Loan Forgiveness

- Submit the final forgiveness application once all requirements are met.

- Wait for loan servicer approval and confirmation of debt cancellation.

Navigating loan forgiveness programs can seem complex, but understanding your eligibility and the application process makes all the difference. If you qualify, this opportunity could help you free yourself from debt and focus on building a more secure financial future. Stay proactive, explore your options, and start your journey toward financial relief today.

Keep following our posts for more insights on federal student debt forgiveness and personal finance strategies!