Student loans are a valuable investment in your education and future career, but missing payments or defaulting can have serious financial consequences. Understanding how to manage your loans effectively can help you stay on track and protect your financial health.

Practical Tips for Refinancing, Deferment, and Negotiating with Loan Servicers

1. Consider Refinancing for Lower Interest Rates

- Refinancing can help reduce monthly payments by securing a lower interest rate.

- Best suited for borrowers with strong credit and stable income.

- Be aware that refinancing private loans removes federal protections like forgiveness programs.

2. Explore Deferment and Forbearance Options

- Deferment allows borrowers to temporarily pause payments, often without accruing interest on subsidized loans.

- Forbearance provides a payment break, but interest continues to accumulate.

- These options can help during financial hardship or unemployment, but should be used strategically.

3. Communicate with Your Loan Servicer

- If struggling with payments, contact your loan servicer immediately to discuss options.

- Loan servicers can help adjust repayment plans or offer temporary relief.

- Keeping an open dialogue prevents missed payments and credit damage.

Best Practices to Prevent Financial Hardship and Protect Your Credit

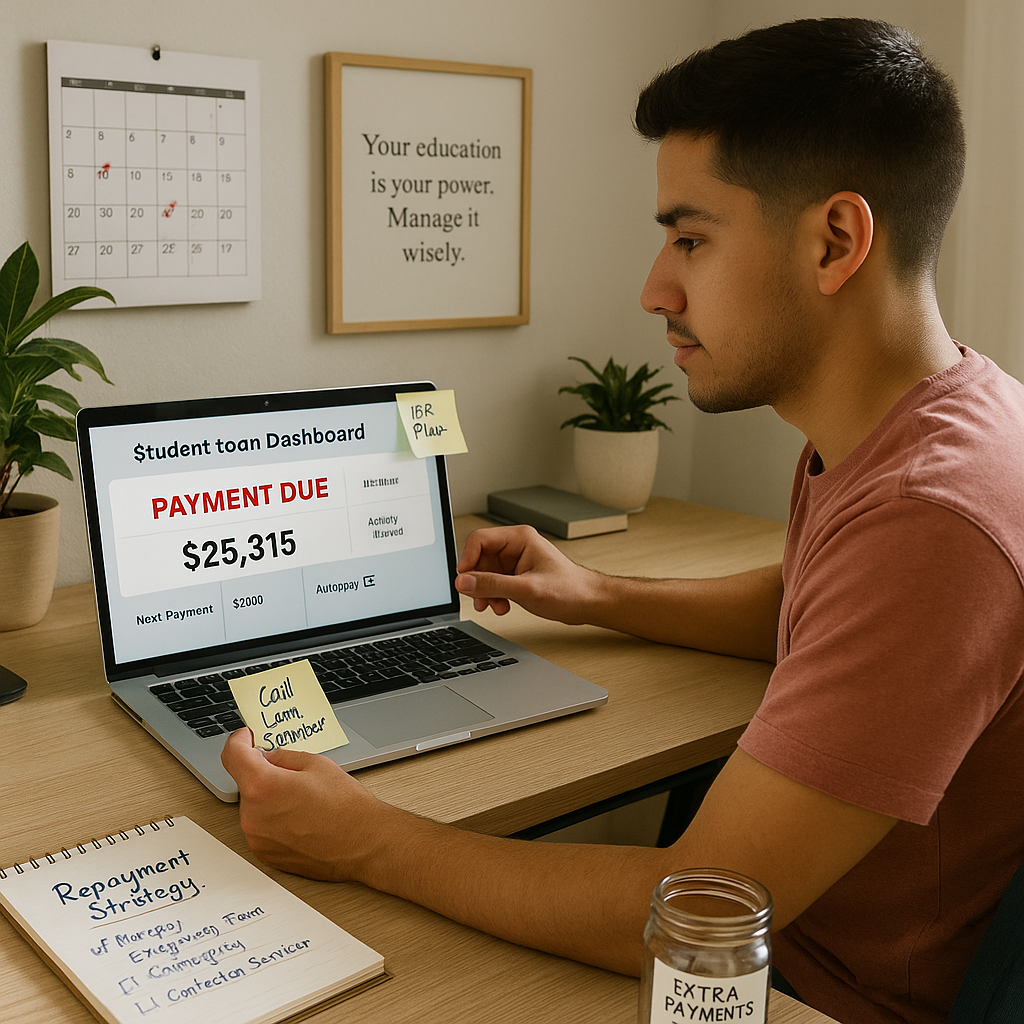

1. Choose the Right Repayment Plan

- Income-Driven Repayment (IDR) plans adjust payments based on income, making them more manageable.

- Standard repayment may be better for borrowers who can afford higher payments and want to pay off loans faster.

2. Set Up Automatic Payments

- Autopay ensures on-time payments, preventing late fees and credit score damage.

- Some lenders offer interest rate discounts for enrolling in autopay.

3. Make Extra Payments When Possible

- Paying more than the minimum reduces interest costs and shortens the loan term.

- Even small additional payments can make a big difference over time.

4. Monitor Your Loan Status Regularly

- Check your loan balance and repayment schedule frequently.

- Stay informed about forgiveness programs and refinancing opportunities.

5. Build an Emergency Fund

- Having savings can help cover unexpected expenses without missing loan payments.

- Aim for three to six months’ worth of expenses in a separate account.

Managing student loans wisely is essential to maintaining financial stability and securing a strong future. By taking proactive steps – whether through refinancing, repayment strategies, or financial planning – borrowers can stay in control of their debt and avoid unnecessary stress.

A student loan is more than just financial aid; it’s an investment in your education and career. With the right approach, it can open doors to success without becoming a burden.

Stay committed to your goals and make informed decisions.

We’re here to help – follow our upcoming posts and stay ahead in your financial journey!