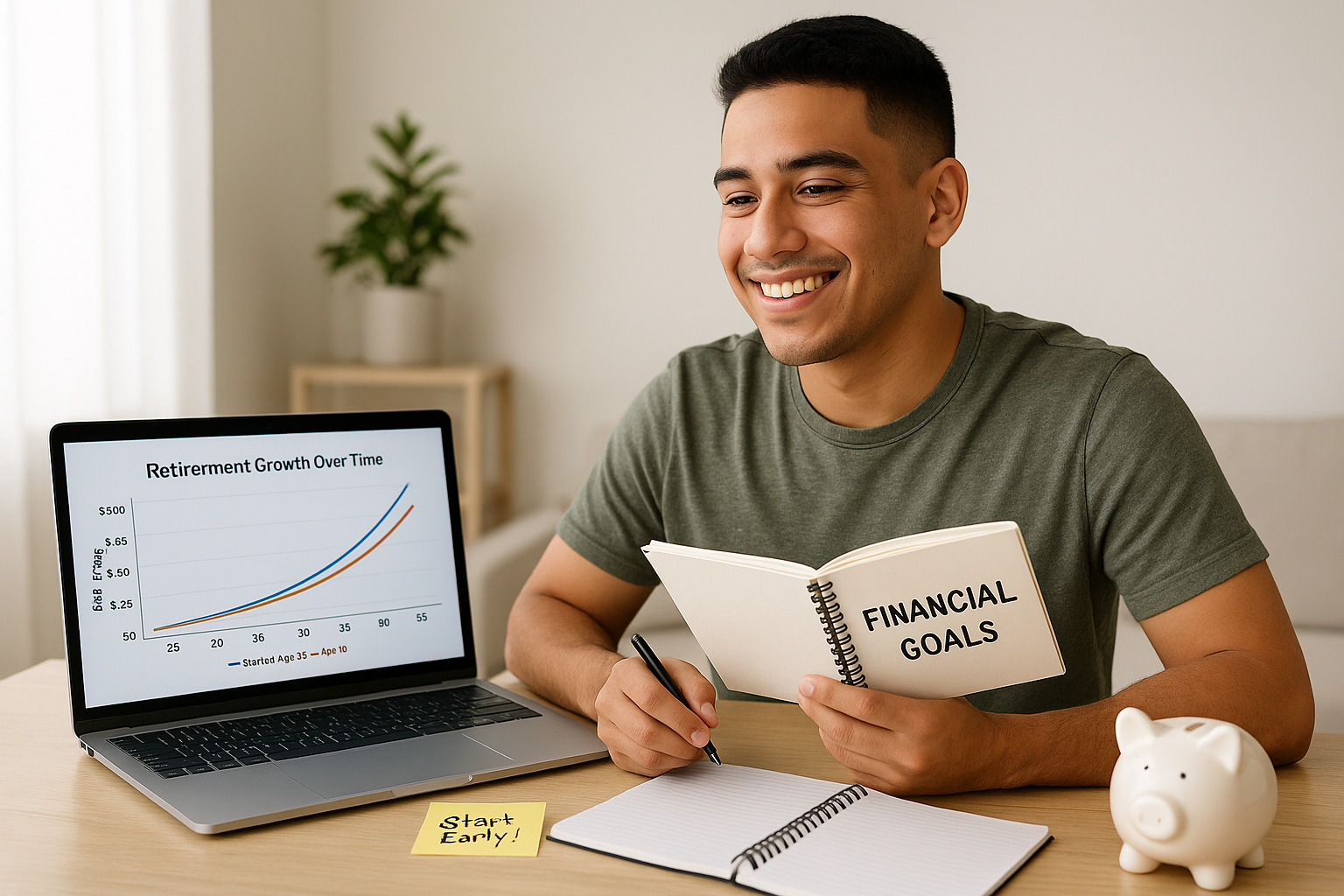

Planning for retirement might feel like something you can postpone, but starting early can make a significant difference. By taking proactive steps today, you’re setting yourself up for financial stability and freedom in your later years. Let’s explore why early retirement planning is essential, the benefits it offers, and how compound interest can exponentially grow your savings.

Benefits of Early Retirement Planning

Starting your retirement planning early provides several key advantages:

- More Time for Savings Growth: The earlier you start, the more time your savings have to grow. This allows you to accumulate a larger retirement fund with less effort.

- Lower Financial Stress Later: By spreading out contributions over decades, you reduce the pressure to save large amounts in a short timeframe as retirement approaches.

- Flexibility and Options: Early planners can adapt more easily to life changes, such as a career shift, medical expenses, or unexpected costs.

- Ability to Retire Comfortably: Starting early allows you to better achieve the lifestyle you desire in retirement, whether that means traveling, pursuing hobbies, or simply enjoying peace of mind.

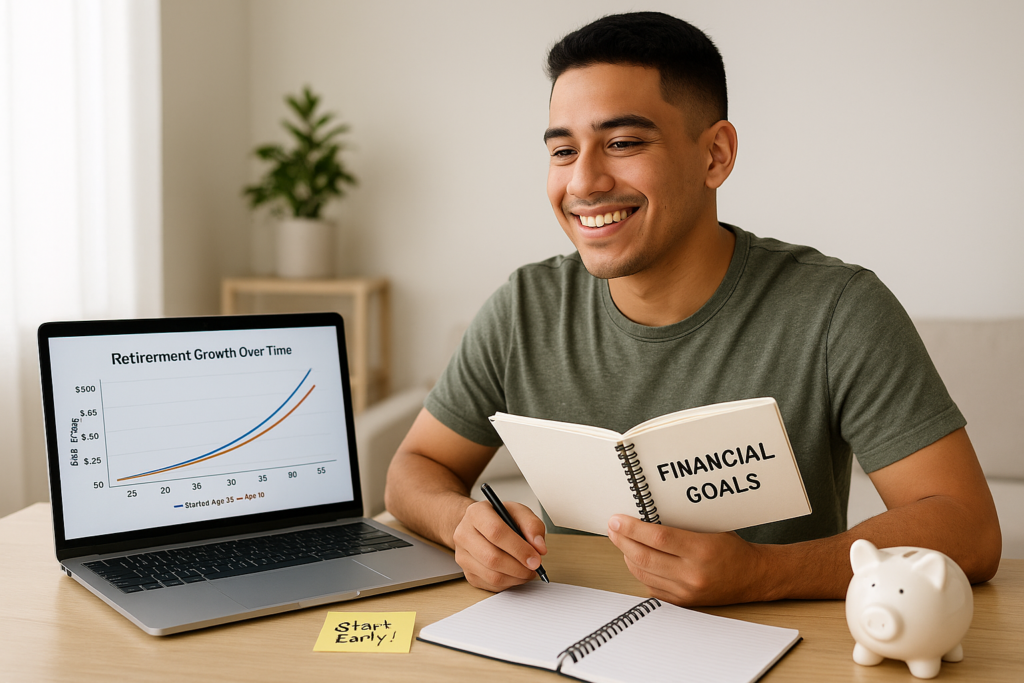

The Impact of Compound Interest on Retirement Savings

Compound interest is one of the most powerful tools for growing your retirement fund. Here’s how it works and why it’s essential to start early:

- How Compound Interest Works: When you save money, you earn interest on both your initial investment (principal) and the interest that accumulates over time. For example:

- If you invest $1,000 at a 5% annual return, by the second year, you’ll earn interest on both the $1,000 and the interest earned in the first year.

- Why Starting Early Matters:

- Imagine two savers, one starting at age 25 and the other at 40. Both invest the same amount monthly. The 25-year-old will see exponentially greater returns due to the longer period for compound interest to work its magic.

- Example of Growth:

- Saving $200 monthly from age 25 to 65, with an annual return of 7%, can grow to over $500,000. Starting at 40 would cut that amount by more than half!

Conclusion

Planning for retirement early isn’t just about saving money; it’s about creating a future you’ll feel excited and secure about. The combination of reduced stress, increased flexibility, and the incredible power of compound interest makes starting today the best decision you can make for tomorrow.