Credit scoring is evolving – and that might be good news for homebuyers. If you’ve ever applied for a credit card, car loan, or mortgage, you’ve probably encountered your FICO score. It’s long been the go-to credit model for lenders assessing how likely you are to repay loans. But now, there’s a new contender joining the mix – and it could lead to more flexibility and opportunity in the mortgage market.

The Big Shift

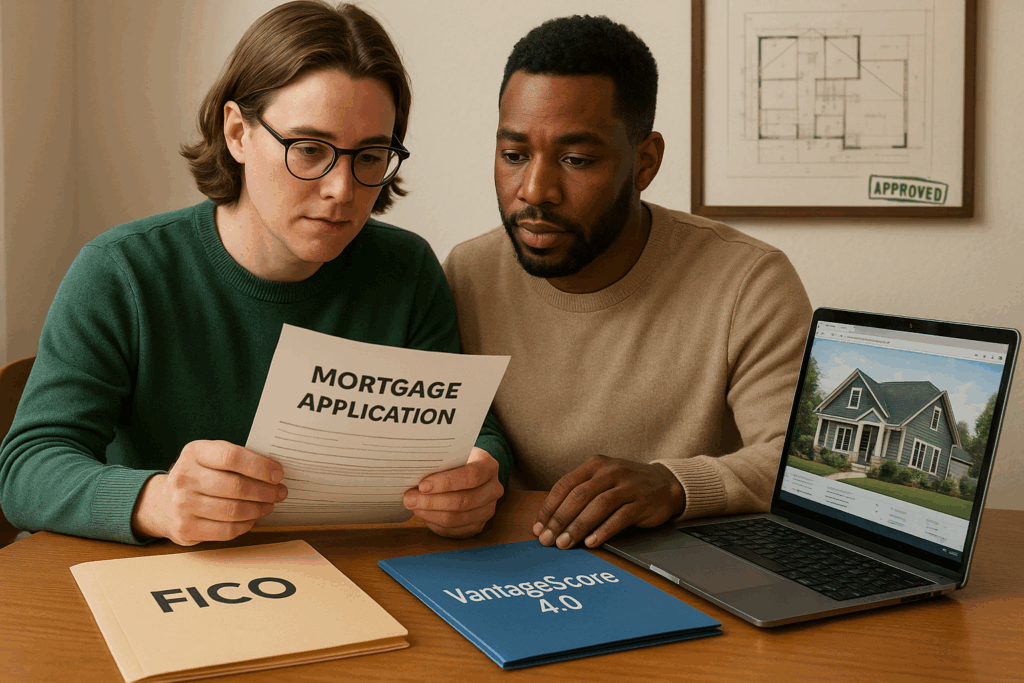

The Federal Housing Finance Agency (FHFA) just approved a major update:

Lenders writing mortgages backed by Fannie Mae or Freddie Mac can now choose between two credit score models:

- FICO: the tried-and-true industry leader

- VantageScore 4.0: a newer model that expands the scope of scoring

This move marks a new era of choice and competition in a space that, until now, has largely been dominated by a single scoring system.

Why It Matters

More scoring options mean lenders can tailor their approach – potentially unlocking better opportunities for borrowers.

- FICO remains deeply respected and widely trusted across the financial industry.

- VantageScore offers a different lens, using alternative data sources like rent and phone payments to paint a fuller picture of a borrower’s financial behavior.

- Lower costs for lenders could eventually result in better terms and broader access for buyers.

This isn’t just about replacing one score with another, it’s about recognizing that creditworthiness can be measured in more ways than one.

FICO’s Enduring Strength

Though some headlines focused on FICO’s market response, its role in lending remains strong:

- Most mortgage lenders continue to rely on FICO due to its legacy, reliability, and strong underwriting history.

- Transitioning to a new score model takes time and comes with compliance challenges and strategic considerations

- Consumer awareness of FICO remains high, making it crucial for borrowers to maintain healthy scores in both systems

FICO isn’t going anywhere, it’s still a cornerstone of responsible lending.

What This Means for You

Whether you’re a first-time buyer or simply credit-curious, this change may lead to:

- Greater fairness and access, especially for those without traditional credit histories

- Improved offers and fee reductions as lenders compete for borrowers

- More ways to show financial responsibility, even if your journey doesn’t include credit cards or loans

Credit scores are becoming more nuanced, which means lenders may start recognizing potential where they once saw risk. For many, that shift could make the dream of homeownership a little more attainable.

Curious to learn more?

We’ve got plenty more tips, tools, and smart financial insights coming your way. Follow our blog and let’s navigate the world of credit, savings, and homeownership together, because financial confidence starts with knowledge.

And last, but not least: Ask Gabi, the “judgment free zone” for all of your financial questions!

Talk to Gabi here, for IOS users. And here, for Android users.

Stay tuned! We got you!