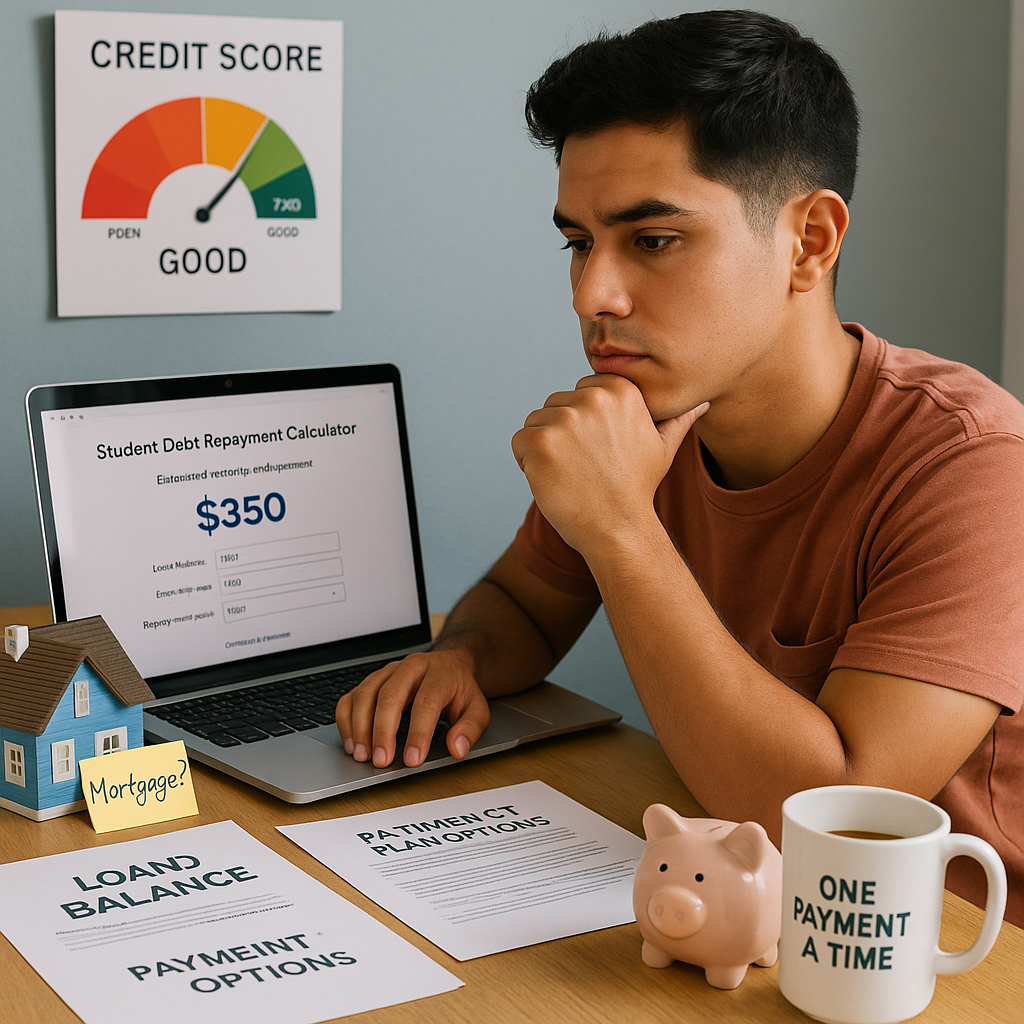

Student loans play a crucial role in shaping the financial future of millions of Americans. While they open doors to higher education, they also bring long-term financial responsibilities. Using a student debt repayment calculator can help borrowers make informed decisions and effectively manage their loans. Understanding how student loan repayment affects credit scores, homeownership, and financial security is key to navigating this journey strategically.

How Student Loan Repayment Impacts Credit Scores, Homeownership, and Financial Security

Credit Scores and Student Loan Repayment

- Using a student loan repayment calculator helps track payments and assess their impact on credit.

- On-time payments improve credit scores, opening doors to better financial opportunities.

- Missed or late payments harm credit, making future borrowing more difficult.

- A high student loan balance can affect your debt-to-income ratio, impacting loan approvals.

Homeownership and Student Loans

- Student loans calculator tools allow borrowers to evaluate affordability before purchasing a home.

- Lenders consider student debt when approving mortgages, possibly delaying homeownership.

- High student loans interest rates may slow down savings for a down payment.

- Responsible loan management and strong credit can still pave the way to securing a mortgage.

Financial Security and Managing Student Loans

- Large student loan payments reduce disposable income, limiting savings and investments.

- A student debt repayment calculator helps create strategies to balance repayment and financial well-being.

- Strategic planning can mitigate financial stress while maintaining stability.

Smart Strategies for Student Loan Repayment and Financial Stability

Choose the Best Repayment Plan

- Use a student loan repayment calculator to compare different repayment options.

- Income-Driven Repayment (IDR) plans help those with lower or unstable income.

- Opting for standard repayment can help pay off loans faster and reduce interest costs.

2. Make Extra Payments When Possible

- Paying more than the minimum reduces interest and shortens the loan term.

- Small additional payments can make a significant difference over time.

3. Keep Track of Your Loan Status

- Regularly check your loan balance and repayment schedule.

- Stay informed about forgiveness programs and refinancing options.

4. Build an Emergency Fund

- Savings help cover unexpected expenses without missing loan payments.

- Aim to set aside three to six months’ worth of expenses in a separate account.

5. Maintain a Healthy Credit Score

- On-time payments protect your credit history.

- Avoid taking on unnecessary debt while repaying student loans.

Using a student debt repayment calculator empowers borrowers to make informed financial decisions, balance student loan repayment with future investments, and achieve financial stability. With proper planning and strategic repayment, student loans can be a stepping stone rather than a burden.

Stay tuned for more tips on navigating student loans and personal finance with confidence!